The key elements you want to have in place when you are awarded a federal grant project

Congratulations! You have been awarded a federal grant. Whether you are a recipient, pass-through entity, or subrecipient, you have been given the unique responsibility of becoming a steward of federal grant funds.

This is a privilege, but also requires diligence, planning, and solid recordkeeping to ensure that you follow the federal requirements as indicated in The Office of Management and Budget (OMB)’s Uniform Grant Guidance, or 2 CFR 200, plus any other federal, state or local agency requirements.

If you are new to federal grants, this might seem very overwhelming, so we’re here to take this step-by-step so you can carefully plan and execute. Want a hint? You will want to start on all of this planning before you even get that federal grant.

Why is a strong kickoff important?

Simply put, your organization could be in big trouble if you don’t follow the rules. What kind of trouble? In addition to single audit findings, you could have disallowed costs (meaning you have to pay back the funds to the federal government or pass-through entity), fraudulent actions, and/or potential legal ramifications. Yup, this is serious!

The good news is, that if you follow the rules and communicate with your awarding agency, you will set yourself up for success.

We’ll keep reiterating these concepts here, but we want to focus on 1) solid internal controls and 2) project planning.

Solid Internal Controls

To preface, OMB references the COSO Framework when describing internal controls in 2 CFR 200. COSO is a committee of representatives from five different organizations: The American Accounting Association, The American Institute of Certified Public Accountants, Financial Executives International, The Institute of Management Accountants, and the Institute of Internal Auditors, and collectively they dictate the critical functions and rules to follow to ensure adherence to federal grants administration.

The COSO framework (similar to a Rubik’s cube) has five different components that support operations, reporting and compliance. The components also support different levels of the organization from the entity down to the functional level.

In the world of federal grants, internal controls have three main objectives: effective and efficient operations, reliable financial reporting, and compliance with laws and regulations. Those objectives are supported by five components: control environment, Risk Assessment, Control Activities, Communications, and Monitoring. When the objectives are supported by the main components, there are seven primary benefits: proper use of grant funding is better ensured, errors are better detected and prevented, the risk of fraud is gre

atly reduced, requirements of the grant are met, allowance for timely reporting is provided, and accounting accuracy is increased, as well as taxpayer confidence.

Project Planning

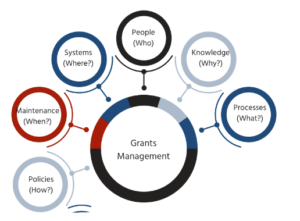

When your organization decides to pursue a federal grant, the focus tends to be on the potential impact on your community, but not necessarily the infrastructure, resources, and knowledge that your organization must have in place to ensure success. This figure illustrates the components to build a culture of compliance.

Organizational components:

- Personnel assigned to administer the grant (includes financial, programmatic, and operational roles). Depending on the size of the organization, this could include more than one role for one person.

- Adequate technology or systems to manage the grant and track key elements like expenses, deadlines, procurement requirements, and other items.

- Knowledge about how to administer the grant and the rules that need to be followed.

- Policies and procedures that adhere to the 2 CFR 200 and other policy requirements.

The Step-by-Step Kickoff Approach

So, you’ve received a federal grant. Now what? Here is our approach to starting the work successfully so you can administer your federal grant with confidence and fidelity.

1. Policies and Procedures: The best way to reduce organizational risk and to ensure that your organization incorporates the requirements of 2 CFR 200 is There are many federal agencies that are requesting these policies and procedures (the natural extension of the internal controls) in practice. This covers a broad range of financial, operational and programmatic elements as required to administer federal grants.

Through these policies and procedures, you’ll want to answer the following questions:

- Has management designed policies and procedures to handle a wide variety of circumstances?

- Do those documents provide a path for handling the unexpected?

- And provide a strong framework to prevent, detect and deter bad things from happening?

The good news is that your organization likely has some of these policies in place (think, travel policy, cash management policy or code of conduct policy). These can take a while to compile, so start off with policies that will most impact the administration of your award, which are likely those related to financial management, procurement and code of conduct, and build them out exponentially.

1. Kickoff with Partners: One of the most challenging parts of managing federal grants is working with different partners. These partners tend to come in the form of subrecipients, contractors, or supporters. The best way to engage all of your partners is to have a kickoff meeting that includes representatives from each entity. This serves as your steering committee.

Before the meeting, it is best to outline their involvement and how they should communicate with your team. The service agreement or contract (depending on the partner relationship) must outline specific terms and conditions, which means national policy requirements, that adhere to 2 CFR 200 requirements. It is critical to have legal counsel review any agreements before they are shared with partners.

As a group, you should review the notice of grant award (NGA)’s terms and conditions. This document also outlines key deadlines and requirements, which can be turned into a project plan for ongoing review. The grant should receive a specific accounting code for tracking, and the approved budget shared with the team so everyone is aware of how the funds should be spent. If personnel are paid out of federal grants, they must begin to record their time in the accounting system of record, and approved by an authorized supervisor (not the person who recorded their time).

2. Monitoring and Tracking: When working with partners, there are different rules that need to be followed. For instance, subrecipients must be monitored on a regular basis, and should have a monitoring plan in place to assess each subrecipient’s performance. Those that might be deemed more high risk should have more conditions included in the service agreement. Contractors must be checked through SAM.gov’s Excluded Parties List that they are not suspended or debarred from receiving federal grant funding (and should take place on an annual basis if a multi-year grant).

From a financial perspective, a budget reconciliation is conducted regularly to determine whether the funds expended (and obligated) are in line with what was included in the budget; otherwise, a budget modification should be performed.

Whether you track the various deliverables in a spreadsheet, project management system, or grant management system, you’ll need to designate an individual (or team of people) to track and make updates as required to ensure that you are maintaining deadlines and making updates as needed.

3. Recordkeeping: If a tree falls in a forest, does it make a sound? The same goes for grant management. If you comply with all requirements, did it really happen if you don’t have documentation? The answer is no. To ensure that you have evidence of your solid grant administration work, it is critical to maintain electronic files (and some paper copies if needed) of important items such as financial and progress reports, procurement-related items (contracts, procurement criteria and scoring, subrecipient monitoring plans, risk assessments, evidence of partners not being suspended or debarred), equipment logs, time and effort reports, budget modifications, etc.

If you are required to undergo a Single Audit, this information is necessary to share with your auditor as evidence of how you are tracking and administering the grant award.

A strong kickoff will benefit your team and set the stage for successful grant administration. If you take a measured approach and focus on the high priority requirements, it will help make the process seem less overwhelming. Not sure where to begin? We’re happy to answer those burning questions.